This story was republished from the Illinois Answers Project, a nonpartisan investigations and solutions journalism news organization. It was originally published on December 12, 2022.

For years, housing advocates warned of gentrification encroaching in South Side neighborhoods spurred by the incoming Obama Presidential Center, and those alarms are now ringing louder as recent data shows investors flocking to surrounding neighborhoods at higher rates than ever before.

“People should be afraid, they should be concerned about firms that don’t live in this community buying up homes,” said Dixon Romeo, a South Shore organizer with Not Me We, a group fighting for better housing and sustainability. “It’s very simple, the goal of every firm is to make profit, right? In terms of housing that means raising the rent, imposing unnecessary fees and effectively displacing people.”

Across the country corporate investors are buying larger market shares of homes, and that trend has only grown during the global pandemic. That trend is more pronounced in low-income and predominantly Black neighborhoods.

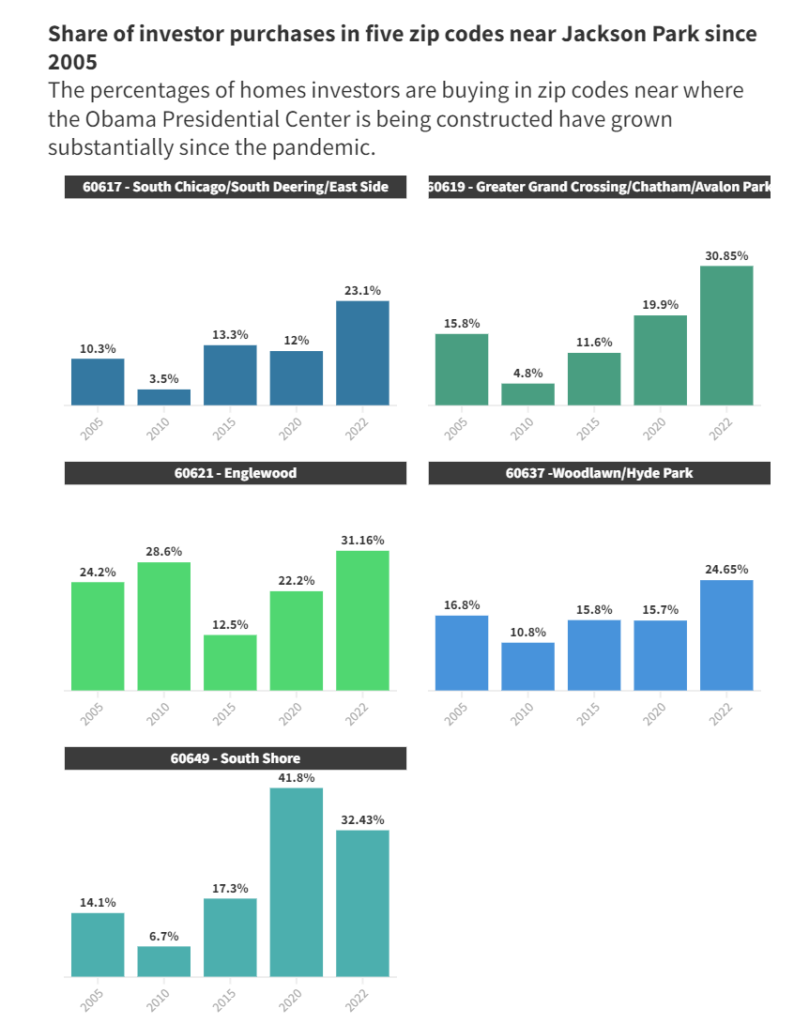

It is no different in Chicago where investors are converging heavily in the neighborhoods surrounding the incoming Obama Presidential Center in Jackson Park as they snatch up nearly a third of homes for sale just in the third quarter of 2022, according to data provided by Redfin, a national real estate brokerage.

While some protections have been implemented in the Woodlawn neighborhood to set aside new affordable housing units—the closest neighborhoods to the center—not much has been done to protect the South Shore neighborhood, where housing is already vulnerable to market whims, Romeo said.

In the zip code covering much of South Shore, investors bought up thirty-two percent of homes for sale in the third quarter of 2022—that’s tied for the most in the city, according to Redfin data.

That’s far more than the seventeen percent of homes investors bought in 2015 before Jackson Park was announced as the home of the center and more than double the fourteen percent of homes bought by investors in 2005 in the middle of the housing bubble.

Redfin categorizes an investor buyer if the name includes an LLC, Inc. or Trust Corp. and whose ownership code on the purchasing deed includes association, corporate trustee, company, joint venture or corporate trust.

And a home is defined as being any single-family, townhome, condominium or residential building with up to four units.

Linda Jennings, seventy-three, said she has been getting phone calls almost every day from people across the country trying to buy her South Shore condominium. She tells them “No thanks” every time.

Jennings said she and her family moved into South Shore in 1958, and they were one of the first Black families to integrate north of 78th Street. She said she went to school in the neighborhood but went to high school in Hyde Park because South Shore High School wasn’t allowing Black students at the time.

“All of that and more is why I am not interested in selling the property—this is home,” Jennings said. “I’ve been living in this condo for the past eighteen years and the impact of the Obama Presidential Center has been on the minds of every homeowner I know and what that is going to mean for our taxes.”

Jennings said most of the homeowners she knows are on fixed incomes and with rising property taxes—and much needed repairs for some of the homes—she isn’t sure enough is being done to protect them.

“I live by myself and I can make ends meet by cutting down on food consumption, but my overall quality of life will change drastically and not for the best,” Jennings said.

This, Jennings said, is why the city should be working harder to protect renters and homeowners like her from being pushed out.

“Gentrification is gradual right now but it is intensifying every year,” Jennings said. “I would like the city to give us some sort of community binding agreement that can help stabilize this neighborhood and allow us to stay.”

Romeo, twenty-eight, said it’s not surprising that investors are buying more shares of homes in the neighborhood he’s called home his whole life. That is why, he said, it is more urgent than ever for the city to pass some sort of community benefit agreement with South Shore like it did in Woodlawn.

Not Me We is part of the Obama Community Benefits Agreement Coalition which successfully fought for the passage of the Woodlawn Housing Preservation Ordinance which puts aside $4.5 million of city money for affordable housing programs. It also establishes affordability requirements for thirty percent of new housing units built on fifty-two Woodlawn vacant lots.

Romeo said it is well past time the city commits to protecting affordable housing in South Shore—and across all vulnerable neighborhoods—as he already sees residents struggling with increased housing costs.

“I want the kids who live in The Parkways [apartment building] or in the Jeffery Towers that go to Parkside [Community Academy], O’Keeffe [School of Excellence], South Shore International College Prep or Powell [Elementary School] to be able to live next to the center and say ‘I can be that, I can be president,” Romeo said. “They are not going to be able to do that unless they can afford it.”

“The Obama Center shouldn’t be like Disneyland; it should be a community centric thing that inspires the youth,” Romeo added.

Not Me We as well as the CBA Coaltion recently submitted 744 signatures to add a referendum onto the Feb. 28 ballot. If those signatures go unchallenged the referendum will ask voters if the mayor and alderperson support a community benefit housing agreement.

This includes funding home repairs, property tax relief, eviction protection, a ban on application and move-in fees, among other measures. It would appear in ten precincts in the 5th Ward.

Romeo said the referendum is nonbinding but will at least show the mayor’s office how important these measures are to the 5th Ward.

Michelle Gilbert, legal and policy director with the Law Center for Better Housing, said it is difficult to say the Obama Presidential Center is the definitive reason why investors are buying more shares of homes in those neighborhoods because it is a trend that is happening across the country.

But that doesn’t mean there isn’t a reason to be concerned.

Investor landlords tend to raise rent and impose fees while also moving quickly to evict renters without just cause, Gilbert said. That’s a big issue for South Shore considering it has had the most eviction filings than any other community area every single year since 2010, according to the law center’s data.

“It’s somewhat cyclical because if there are more evictions there are going to be more buildings that are less economically stable and those are going to be the homes more ripe for investors to pick up,” Gilbert said.

But it is not just South Shore where investors are buying a higher share of homes for sale.

In Woodlawn’s zip code, where some affordable housing protections have been implemented, twenty-five percent of homes were bought by investors. That’s up from 15.8% in 2015 and 16.8% in 2005.

In zip codes covering most of the Greater Grand Crossing neighborhood, investors accounted for thirty-one percent of homes bought which nearly tripled the 11.6% purchased in 2015 and doubled the 15.8% in 2005.

Investors have also gone as far west as the Englewood neighborhood where they purchased thirty-two percent of homes being sold—tied for the most in the city with South Shore. In 2015 that share was just 12.5%.

Sofia Lopez, deputy campaign director for housing with the Action Center on Race and the Economy, called for federal action to support of renters in written testimony before a U.S. House committee holding a hearing on the issue in June.

“At the onset of the COVID-19 crisis, institutional landlords emphasized that their rental portfolios had proven recession-resilient during the foreclosure crisis, suggesting that their recent [single-family rental] investments were similarly resilient investments during the COVID-19 crisis,” Lopez said at the hearing. “Thus, 2020 saw tens of billions in fundraising committed to [single-family rentals] from various institutional investors.”

The country is at a crossroads, Lopez told the Illinois Answers Project, and it is disappointing that little is being done to help renters.

“There is a pattern with private equity and investors buying these homes, and they are targeting Black communities at a much higher rate than ever before,” Lopez said. “They are really preying on this legacy of disinvestment where people can’t buy homes at favorable rates and so many people are just locked out of homeownership.”

While there isn’t much a city can do to intervene in private transactions, there can be things done at the national and state level to protect renters, Lopez said. A policy that doesn’t allow landlords to evict people “without just cause” is one and another is some form of rent control.

But the lowest hanging fruit, she said, was to have some sort of registry in place that would make it clear who owns what property instead of keeping it hidden through LLCs. This will not only identify bad actors but also let renters know who their landlords are.

Construction one recent morning at the Obama Presidential Center at 6001 South Stony Island Ave.

“Everybody needs a place to live and buying more and more homes as an investor is a big issue because it’s not like buying a car—it’s not a luxury good,” Lopez said. “But that doesn’t change the fact that for investors housing is a commodity and a means of building a portfolio which is in direct tension to all of us who need a place to sleep and call home.”

A spokesman for the city, Ryan Johnson, said South Shore is in a different situation than Woodlawn where the city doesn’t own “large swaths of vacant, contiguous land” near the Obama Presidential Center. This makes it difficult for the city to replicate the signature action in the Woodlawn agreement like setting aside fifty-two vacant lots for affordable housing.

The city has made strides to strengthen affordable housing specifically in South Shore. In March, the Department of Housing announced a pilot fund project which would provide financial assistance to owner-occupants.

This grant would help with homeowner association fees and needed repairs.

There is also the Troubled Building Initiative and the Micro Market Recovery Program which provides homeownership opportunities in South Shore.

“As we talk with South Shore community leaders and elected officials, we hear a need for a variety of interventions on behalf of renters and homeowners,” Johnson said. “We will continue looking for ways to build off of the existing South Shore initiatives, such as the Invest South/West multifamily rental development and recent affordable homeownership efforts.”

The city has also stepped in to help residents struggling to make rent with its Emergency Rental Assistance Program which has handed out 1,050 grants totaling $8.5 million in South Shore—more than any other zip code in the city.

But for Romeo, these measures aren’t enough.

“It’s not just renters who are at risk here because as the value of homes go up, so does the property tax,” Romeo said. “People who are on a fixed income, who are probably older, won’t be able to afford a jump in taxes so they have two options: sell or become delinquent. The latter would mean losing your house and equity built over years just for an investor to swoop in and purchase your home for pennies on the dollar.”

Manny Ramos is the accountability and solutions reporter at the Illinois Answers Project.

This gentrification didn’t happen with the Obama Library! The U of Chicago

has had there eyes on Woodlawn since the white flight fled the city for greener pastures (suburbs). The whole area was left with little capital, schools suffered, housing, businesses, Woodlawn was on its own! Just look at 63rd Street from South Park to Stoney Island nothing left no businesses which anchored the community. From Cottage Grove west to South Park little of nothing Empty! But hey the Washington National Park will be renovated and not razed, which is what was wanted! This was my neighborhood and it is gone and you cannot bring it back the heart & soul has been ripped out.