Since fall 2016, organizers with the United Chinatown Organization (UCO), a coalition of small business owners, have been collecting signatures from Chinatown residents. In early January, they frantically organized the signatures into a petition, and on their exact deadline of January 16, they submitted it to the city.

The petition opposed the potential levy of a Special Service Area (SSA) tax along Chinatown’s main commercial strips. The city’s Department of Planning and Development (DPD) reviewed the signatures, and told the Weekly Friday that the petition did not contain the required amount of signatures to stop the SSA from being implemented.

An SSA is a local tax district that funds services such as beautification and security—on top of what the city provides—through an incremental property tax. The services are often meant to improve business, so SSA boundaries normally encompass commercial districts within neighborhoods. Typically, a local nonprofit organization, a “Sponsor Agency,” proposes a new SSA to City Hall, which decides whether to pass the proposal. If approved, the revenue from the additional tax goes into a city bank account controlled by mayorally-appointed Commissioners to disburse as they see fit, with nominal oversight from the city. There are fifty-three SSAs throughout Chicago, and the Chinatown Chamber of Commerce is pushing to create the first one in Chinatown – SSA #73.

The UCO’s petition stemmed from over two years of opposition to the Chamber’s push for the tax. Local business owners initially formed the UCO to resist the Chamber’s proposal.

Community opposition to SSAs in the 25th Ward, which contains Chinatown, has occurred before. In 2013, the nonprofit developer The Resurrection Project (TRP), which has close ties to Alderman Danny Solis, proposed a SSA tax on businesses along 18th Street in Pilsen. The proposal was eventually blocked by 18th Street store owners and activists with the Pilsen Alliance.

In Chinatown, the UCO and the Chamber have both passionately expressed their goals of improving business in Chinatown, but they possess vastly different ideas of how exactly to achieve those goals. The continuous tensions around the SSA highlight the chasm between the Chamber and small business owners making up the UCO.

These small business owners have been questioning the Chamber’s actions. They suspect that the Chamber failed to comply with city policy by not submitting the required amount of signatures in support of the proposal, and also believe that the Chamber wrongly excluded most of the community when drafting its proposal. The business owners continue to feel profound distrust towards the Chamber, an organization whose professed mission is to support the local business community.

Chamber leaders first began drafting an SSA proposal in 2015, according to Darryl Tom, president of the Chamber from 2015 to 2016. They were motivated by the new developments occurring in and around Chinatown.

In 2014, the city began construction on the Wells-Wentworth Connector, a multi-phase project that aims to create a new road between the Loop and Chinatown. The 62-acre parcel of vacant land between Roosevelt Road and Chinatown, which the the Connector will run through, is also being privately developed into what is being pitched as a “city within a city,” containing residential, office, and retail space, and is slated to begin construction next year. Moreover, in 2016, the 101-room Jaslin Hotel opened in the heart of Chinatown. Then, last fall, Wintrust Arena, a new basketball arena for DePaul University, opened as an expansion of McCormick Place directly east of Chinatown.

The city also announced a $40,000 grant to the community group Coalition for a Better Chinese-American Community (CBCAC) to study how to improve safe foot traffic in Chinatown last year. Seeing that Chicago’s Chinatown is one of the only in the country whose Chinese population has continued to grow, city planners are committed to investing in Chinatown to take advantage of its growth and preserve its cultural identity.

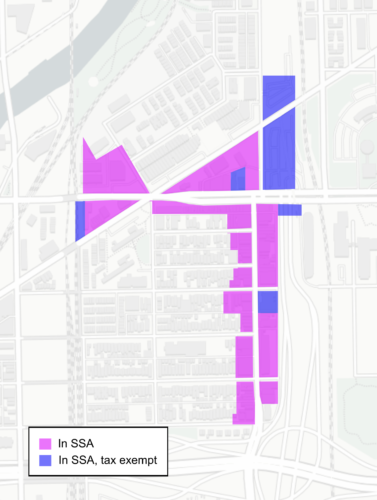

In light of these new developments, Chamber leaders believe that there will be many more visitors to Chinatown in the near future. The Chamber’s goal for the SSA proposal is to beautify Chinatown to ensure that visitors will continue to come and support local businesses—the Chamber’s constituents, said Tom. The initial proposal specified boundaries that encompassed essentially every commercial or mixed-use building in the core of Chinatown, and specified services such as sidewalk trash and snow removal and decorative banners that cannot be fully provided by the City.

The Chamber worked out a budget that would fund the proposed services, and then, knowing how much tax revenue the SSA would have to collect to meet the budget, worked backwards to determine a property tax rate of 0.31 percent.

After the DPD vetted the Chamber’s proposal, the City Council’s Committee on Finance held a required public hearing to discuss the SSA in October 2016. After testimony from supporters and opponents, aldermen on the Committee found that many SSA opponents misunderstood the tax to be much greater than what the Chamber proposed, and postponed its decision until the Chamber addressed the miscommunication.

The Chamber then held four public educational meetings, and in November 2017, the Committee on Finance held a second public hearing. The proposal this time included a smaller budget and excluded the outdoor Archer Avenue mall Chinatown Square from the SSA boundaries. At the second hearing, a DPD official said that it amended the boundaries after finding that an unpaid tax liability exists for Chinatown Square. A spokesperson later clarified to the Weekly that the DPD didn’t want to confuse property owners in the Square by adding an additional SSA tax on top of the taxes they already have to pay back.

It is unclear whether the resistance from Chinatown Square business owners affected the change in boundaries; the Chinatown Square Association had pleaded with aldermen during the first public hearing to be excluded, citing internal fees that business owners in the outdoor mall already pay for security and maintenance. Then, three months before the second hearing, supporters of the UCO hung banners throughout Chinatown Square denouncing the SSA.

At the second hearing, many business owners again still spoke up in opposition. Yet just one month later, the Committee decided to approve the SSA, quickly followed by the full City Council and mayor’s office. There was one last chance for the UCO to block it, however—per Illinois SSA law, if within sixty days of the public hearing, at least fifty-one percent of property owners and at least fifty-one percent of voters registered with addresses in the SSA sign a petition opposing the tax, all proceedings stop, and an SSA can’t be proposed for another two years.

With this being its only course of being able to stop the SSA at the City Hall level, UCO members scrambled to collect enough signatures by January 16, submitting 265 in the end. However, a little over a month after they were submitted, the DPD denied the petition, telling the Weekly that while the UCO provided enough signatures from property owners, the petitions did not contain enough from voters.

The SSA, and its $93,605 annual budget, will now move forward, with the city set to appoint the SSA Commissioners in June, according to the DPD. Darryl Tom, former president of the Chamber, has resigned from the Chamber to apply to become a Commissioner. Seeing that there were still a majority of business owners who signed the UCO’s petition, Tom said that the Commissioners will need to work on “demonstrating the value of the SSA” to the opposing business owners through further public engagement.

“Over time, the business owners will find [the SSA] to be a productive endeavor,” Tony Shu, a Loop attorney who now serves as the Chamber’s president, said.

The UCO’s next steps have not yet been determined, said Joanne Moy, director of the UCO and a liaison with the Chinatown Square Association. Robert Hoy, an attorney based on Cermak Road and the legal advisor for the UCO, said that its members are at an “investigative juncture.” They are questioning how the DPD calculated the percentage of registered voters, Hoy said, because they believe that registered voters who no longer live in Chinatown should not be counted.

When we first sat down in his office, Dr. Ing Hsu Wu pulled out a massive fluorescent green binder from under his desk. He opened the binder to reveal newspaper clippings, public hearing transcripts, SSA legislation, and finally, a timeline that he handwrote of all the SSA proceedings up until now.

Dr. Wu, who runs a gynecology clinic in Chinatown Square and is a former president of the Chinatown Square Association, has ardently scrutinized the Chamber’s actions ever since it first proposed the SSA in 2015. Though he is not officially part of UCO, he has been a leading member of resistance efforts against the SSA, speaking in public meetings or to the media in defense of his patients who have expressed worries about the tax.

“It is a tax on my community,” he said.

Considering the Chamber’s deep involvement with the local community, the bitter reaction from business owners like Dr. Wu is surprising, said Chamber president Shu. The Chamber has long been dedicated to community projects, such as the annual Dragon Boat Race, he added. It has also garnered support for its proposal from Chinatown leaders outside of the business community. Bernie Wong, founder of the nonprofit social services agency Chinese American Service League and who has a street in Chinatown named after her, has publicly lent her support to the SSA.

One of the reasons the UCO and its supporters have been so ardently opposed to the SSA is that they have found the Chamber’s actions to be opaque and dubious.

Robert Hoy said he questions whether the Chamber complied with city policy. Before submitting its proposal to the DPD, the Chamber was required by city policy to collect support signatures of the taxpayers of at least twenty percent of the parcels within the proposed SSA boundaries. Documents provided to the Weekly by the DPD show that the Chamber did hit exactly twenty percent, in two sets of signatures submitted in June and August 2016, following city policy. The Weekly found that at least one-third of the parcels on the full signatory list are owned by Chamber board members, future board members, and in one case, the parent of a board member.

Hoy also questioned why the Chamber did not submit a new proposal after the DPD changed the SSA boundaries. He “speculate[s] that if the Chamber tried to file a new proposal [that excluded Chinatown Square], they would not have gotten the [the twenty percent support signatures].” A DPD spokesperson told the Weekly that the Chamber was not required to submit a new application to amend the boundaries.

The question of Chinatown Square’s status also remains up in the air. A week before the second hearing, Solis wrote an email to his staff, provided to the Weekly by the UCO, saying he hopes the tax issue is resolved “so that Chinatown Square is eventually folded into the SSA. Chinatown’s vibrancy and prosperity should be shared by all of the community and not just one section of it.” During the second hearing, Solis left open the possibility of later adding the Square back into the tax district, once the Square’s unpaid liability is paid back. After the hearing, the UCO sent a letter to his office seeking clarification as to whether the Square might be later included back into the SSA’s boundaries. Solis’s response, provided to the Weekly by the UCO, evaded answering the question.

“I was very concerned to learn of the property tax issue that the Chinatown Square is currently faced with,” it reads. “I am sensitive to how this very pressing issue should take priority over and above any other matters within the community. Therefore, at this time, I encourage the community to focus all their time and efforts on resolving this unfortunate financial burden for the [Chinatown Square] Association and its members.”

Solis did not respond to a follow-up letter sent by the UCO. In a statement, a DPD spokesperson described the establishment of SSAs as “always a community-led process….Decisions about any future extensions of the Chinatown SSA would have to be initiated by the community and the alderman.”

Additionally, Dr. Wu said that when the Chamber drafted its proposal, it did not involve the whole community. Indeed, when creating the draft, the Chamber hired a private consulting agency called PLACE Consulting, which has helped form a majority of the SSAs in Chicago, and created an advisory committee of thirteen—with eight being Chamber board members—even though city policy states that the committee should include “primarily property owners/tenants in the proposed SSA.”

Responding to criticism about the makeup of the committee, Chamber president Tony Shu said that there are so many citizens in Chinatown that “if we did a poll to ask [who wanted to be on the committee], nothing would get done,” and so the Chamber reached out to its partners to form the committee. The issue was acknowledged by Solis during the first public hearing.

Chamber and Parking Corporation board member Raymond Lee confirmed to the Weekly Monday that the lot will likely be developed. Developing the lot, which sits along what will be the Wells-Wentworth Connector, was officially proposed in the 2015 Chinatown Vision Plan authored by the Chicago Metropolitan Agency for Planning, CBCAC, and Solis’s office—and which Lee was on the steering committee for. If the lot is developed, Lee said, then the SSA would serve to provide services that revenue from the lot currently funds, such as street garbage pickup.

Who would develop the lot and profit from its commercial use is not yet known. Hoy believes that Chamber board members will personally develop the lot, while Lee said that “many people applied” to develop it and ultimately the Illinois Department of Transportation, which owns the lot, will decide.

The UCO and its supporters see inherent problems with the services the Chamber wants to provide with the SSA. Hoy does not see beautification services as “concrete and measurable” in terms of actually increasing visitors and sales.

“When you go to Disney World, do you look at the trees? You go for the attractions. What attractions [has the Chamber] planned?”

Hoy believes that tourism efforts should be directed towards attractions, such as a rickshaw service between Chinatown and McCormick Place, rather than beautification. This attraction is measurable, he said, because you can calculate the sales made with each ride, and it is also interesting enough to attract media coverage that will help further draw in visitors.

Dr. Wu also does not see beautification services as conducive to business and tourism. He said that change should start within the businesses, by improving customer service and interior design.

According to research on the effectiveness of SSAs and other types of Business Improvement Districts (BIDs), whether the Chinatown SSA would actually improve sales is ambiguous. Stacey Sutton, an urban planning professor at the University of Illinois at Chicago (UIC), found in a 2014 study that New York City’s community BIDs – those with small budgets and located in weak economic areas with local businesses and less foot traffic – actually drove sales down. This is likely because community BIDs lack organizational capacity and don’t receive enough visitors to leverage expanded consumption, Sutton found. On the other hand, destination BIDs – those with larger budgets and located near major commercial areas with much foot traffic – increased sales, but only modestly.

The proposed Chinatown SSA potentially possesses aspects of both community and destination BIDs. Its proposed budget is small and its boundaries contain mostly local businesses, but also, with the new developments in and around Chinatown, foot traffic within the SSA could significantly increase. Even if the Chinatown SSA aligns more with a destination BID, though, as Sutton’s research suggests, the benefits would be minimal.

The business owners are also concerned that “there are no milestones” established in the SSA proposal, said Hoy. “We need accountability.”

Accountability for SSAs in Chicago is indeed weak, according to research by UIC urban planning professors Gina Caruso and Rachel Weber. In 2008, they found that the city sent out annual performance measure forms to SSA program managers, but the managers are not penalized if they don’t submit the forms. Additionally, they found the form itself to be flawed, confusing outputs with performance measures. For example: it listed the number of new plants as a performance measure, even though plants do not indicate actual increases in visitors or sales.

When asked whether the DPD currently enforces the requirement that SSA program managers provide the city with performance measure forms, a spokesperson said, “Each SSA must submit four quarterly reports to DPD. Those reports include performance measures and satisfy that requirement.”

Moreover, the UCO and other opponents oppose the process of how SSAs are established. Per city policy, SSA sponsors are required to collect signatures of taxpayers of just twenty percent of the parcels within the proposed SSA to bring the proposal to the DPD for approval. However, to stop the proposal from passing, as noted above, there must be a majority to sign a petition. For many local business owners, this process – in which only a minority is required to propose the SSA, but a majority is required to stop it – is unfair.

“The laws are not written to protect common people,” the UCO’s Joanne Moy said. “They are designed to benefit a select few.”

The Chamber leaders are “not elected by the people of Chinatown,” declared Leslie Moy, a UCO member who until recently owned property in Chinatown Square, in the second hearing.

The governing board of the Chamber is elected only by members of the Chamber. However, Chamber membership is open to all business owners, with annual membership fees starting at $220 for small businesses with 24 employees or fewer, and reaching $1000 for companies with over 100 employees. So, while local business owners could join the Chamber and help choose the leadership, many don’t.

The Chamber has made “a positive effort to reach out to” the resisting business owners, said Shu, by suggesting that they apply to be SSA Commissioners. Dr. Wu and Robert Hoy said they were asked to apply, but they declined.

On the surface, the business owners and the Chamber leaders diverge on the issue of taxation. Lee, a Chamber board member, noted in the first hearing that he “personally own[s] about five properties in Chinatown.” The SSA “means [he will be taxed] more money as an owner of the property…but in the long run, we make it so that the tourists continue to come.”

Other local business owners, on the other hand, see the SSA tax as an additional burden. In the first hearing, Pat Jan, owner of Judy’s Cosmetics in Chinatown Square, noted that along with a potential SSA tax, “we also have a sales tax increase” and “a city-mandated wage increase.” Lorac Chow, who runs the nonprofit Gee Tuck Sam Tuck Association on Wentworth Avenue, said in the second hearing that “Chicago already has the second highest tax rate in the whole country.”

“All this tax, we’re simply paying too much tax,” said Chow.

Beneath the surface, the business owners and Chamber leadership’s divergent attitudes about the tax is rooted in their vastly different daily lives. Dr. Wu described the working conditions of local business owners.

“Every morning I go to the bakery at 8am, but they [the bakery-owners] have to start working at 5am. And all the people working at the restaurants go to the grocery store from 6 to 8am, and work until midnight.” For these business owners, the little money acquired from working so long is extremely valuable, and so even a small tax feels like a large burden.

The Chamber’s board members and executives, on the other hand, mostly work in law, business, or finance. They own property in Chinatown, but it’s unclear whether they personally run the businesses in their properties. Former Chamber president Darryl Tom, for example, said that he rents out his property to tenants. SSA opponents charge that Chamber leaders not only have no experience of the working conditions of the small business owners along Archer or Wentworth but also wouldn’t be likely to be subject to the SSA tax burden if they rent out their properties. According to Sutton, a business improvement tax is typically treated as a ‘pass-through’ tax, meaning that property owners increase rent for their tenants rather than pay tax themselves.

Disconnect between the two groups is evident also in their varying English proficiencies. Chamber leaders, fluent in English, often have had experience interacting with city officials, while many business owners have not fully grasped English nor had many opportunities to work directly with the City. At the second hearing, Chinatown Square store owner Jan said that she was speaking for business owners who accompanied her but could not advocate for themselves in English.

With such significant discrepancies existing between SSA opponents and the Chamber leaders, business owners have grown increasingly cynical towards the Chamber’s actions. Hoy, for example, believes that the Chamber is too powerful.

“The SSA proponents want to be the government. They want to tax you to control your property. If you don’t comply, then you get your property taken away,” Hoy said. He refuses to collaborate with them and apply to be a Commissioner, saying, “Do you really think my vote against their vote will have any effect?”

Chamber president Shu contrastingly expressed that everything the Chamber does is “transparent,” and that the Chamber only embarks on projects with “a long-term view of Chinatown.” The resisting business owners think that the Chamber leadership is “heavily influenced” by commercial interests, Shu said, but “that’s farthest from the truth.”

As the SSA opponents continue to scrutinize the Chamber, Chamber leaders have also gotten more frustrated. “They just want to tear down what some good people are doing,” Shu said.

The chasm between the two groups only continues to grow.

“I am sincerely confident that everyone here today has the same goals and aspirations for the Chinese community….The only difference we have is how this will be accomplished and who will manage this process,” said local property owner Leslie Moy in the second hearing.

This is the central issue, and so far, local business owners and Chamber leaders have only pushed each other farther as they continue to seek the “same goals and aspirations.”

Dr. Wu sees this divergence between the two groups as a grave issue for the community. At the end of his interview, he put all the documents back in his green binder, took out a pen and paper, and began writing in Chinese. “水可载舟,亦可覆舟” – “the water can carry the boat, it can also drown the boat.” The people, the “water,” do not support the SSA, and yet the Chamber leaders, the “boat,” are pushing for it. Dr. Wu foresees that the boat is bound to capsize and that the entire community is bound to feel the ripple effects.

Sam Stecklow contributed reporting

Update 2/13: The story was updated to reflect new reporting on Alderman Solis’s intentions to add Chinatown Square back to the SSA

Correction 2/13: The story was updated to reflect the fact that the Chamber of Commerce did submit the required signatures of twenty percent of the parcel owners in the final SSA boundaries to the DPD. Previously, based on documents the DPD had provided to the Weekly, the story reported the Chamber had only submitted twelve percent. As the DPD later informed the Weekly, the documents that were initially provided contained only the signatures the Chamber submitted in June 2016. After the story’s publication, the DPD sent the Weekly the remaining signatures that were submitted by the Chamber in August 2016, which is allowable per city SSA policies.

Update 2/14: The story was updated to reflect the fact that Leslie Moy does not currently own property in Chinatown Square, and that Robert Hoy’s office is on Cermak Road, not Archer Avenue.

Support community journalism by donating to South Side Weekly

I wished, I knew about this meeting, on behalf of Paul F. Lam, he would had something to say, as a member Lam Sai Ho Tong.

Excellent story on the contrast in perspectives that eventually resulted in formation of Chinatown SSA#73. Perhaps a valuation of properties could be a proxy for metrics, such as visitor count or business sales, to evaluate a SSA’s effectiveness.